“When you are faced by a prospect of famine, your first impulse should not be to go after the only planting seeds you have kept in your granary for the next planting season. That would be a strategically wrong move.”

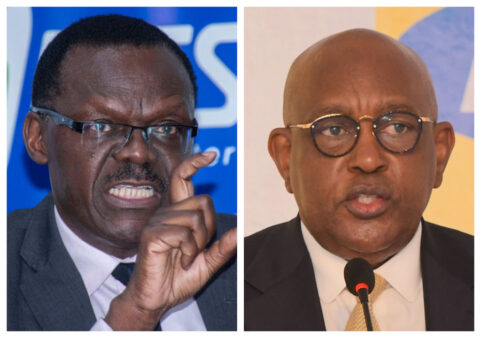

That is how Richard Byarugaba, the National Social Security Fund (NSSF) Managing Director, summarises the calls by some members of the public to be allowed to access part of their NSSF savings- to defend themselves against the potential negative impacts of Covid-19 on both the economy, especially their personal economy.

Opposition stalwart, Dr. Kizza Besigye sparked off this debate about a fortnight ago by asking NSSF to consider rolling “out a programme to pay out a portion of members’ savings to afford them vital support through the Covid-19 crisis.”

“Isn’t this what social security; a safety net, is about?” he asked on his Twitter account.

Besigye’s calls were joined by Members of Parliament – Allan Ssewanyana (Makindye West), Muhammad Nsereko (Kampala Central), Moses Kasibante (Rubaga North) and Geoffrey Macho (Busia Municipality), who suggested that NSSF savers be allowed to access between 10%-30 of their savings.

“If NSSF can lend UGX7 trillion to Bank of Uganda by buying its treasury bills, why not give or lend to the people who save with it,” wondered the MPs.

Days later, businessman and industrialist, Amos Nzeyi also made a hint about NSSF money, in his March 20th open letter to President Yoweri Museveni. Discussing the potential impact and solutions to the Covid-19 crisis on the economy, Mr. Nzeyi, too did call on NSSF to consider investing in some of Uganda’s indigenously-owned and strategically important companies that may be hit too badly by Covid-19 that banks wouldn’t even consider lending to them.

“In the medium term, the government should consider restricting NSSF equity investments into Ugandan-owned or domiciled businesses until Uganda stabilises. Mr. President you may want to for example know that more than 50% of NSSF’s equity investments as at 30th June 2018- were invested in foreign companies,” he said, adding: “At this critical time, NSSF investments, should benefit Ugandan-based companies more, after all they do contribute 66% of this fund.”

Unusual times call for unusual solutions

Most recently, on April 5th, Robert Kabushenga, the Chief Executive Officer of Vision Group, had a different but similar proposal altogether for NSSF. In his view, NSSF should work out an arrangement to bail out, on a selective basis, its members who as a result of Covid-19 may find themselves out of job and are unable to honour their loan obligations. That way, the economy can avoid the negative effects of having too much liquidity as a result of the NSSF pay-outs, but at the same time NSSF members are protected from losing their assets to banks, while the banking system is protected from going belly-up due to heavy Non-Performing Loans- that some experts say, could go up to between 7-10%.

“That will help them (NSSF savers) recover in case of lost salary income, keep their assets from being taken over by banks, maybe free up some disposable income while at the same time, this will improve bank liquidity and in turn keep lending up, which will then help with post-Covid-19 economic recovery,” argues Kabushenga.

“You are going have people leaving employment- and many in the tourism and transport sectors have already left- almost entire sectors are closed. If those people have no income they are likely to default on their bank loans. Even if they didn’t have loans with banks, you are going to have depressed demand. If the banks are faced with increased defaults and there is generally depressed demand, then the banks will be stuck with collateral that no one is willing to buy. Vultures will move in. If I own a UGX300 million house, and owe the bank UGX200 million, the bank is going to sell it for UGX150m because there are no liquid buyers. Even if the central bank makes money available to the commercial banks, there will be no borrowers because interest rates will be high as banks run off to buy treasury bills and bonds,” Kabushenga told this reporter on phone.

“What I am suggesting is, give people their money that you are sitting with, they clear the banks so they don’t lose their assets and possibly create some little disposable income. There you will reduce social bitterness and the social costs that come with too many people being out of jobs- there will be social stability,” Kabushenga insists.

We reached out to Stephen Kaboyo, the Founder and Managing Director Alpha Capital Partners, an indigenous Ugandan firm focusing on sovereign asset management, foreign exchange trading strategies and financial markets advisory on his views about a 10-20% payout by NSSF to its members.

We asked him, what if the government made a one-time provision for NSSF to release up to between 10-20% of NSSF savings, to its 1.9 million NSSF savers as a way of stimulating the economy, would release up to UGX 2 trillion (USD552 million) over the next one year into the economy, which can stimulate the depressed demand in sectors like agriculture, manufacturing, retail, education, tourism etc. This could in turn, manage other possible knock-on effects such as non-performing loans. This would save an already stretched and debt-burdened government from over-borrowing locally and internationally and having to pay-off unsustainable stimulus package and tax incentives. It will also keep several jobs. The government can then focus on paying off domestic arrears and other priorities, further stimulating the economy.

“It is a radical idea that should be explored. There may be no legal provision to support it, but in times like this, where masses are going to be out of employment, social security benefits can be tweaked to offer some sort of relief,” Kaboyo told us on email

“There is always a debate over what effective stimulus package a country should put in place in times like this. It is very important to distinguish between those measures that will have effect, in the very near term and those that have long term effects. In our current dilemma, any stimulus package should aim at saving businesses that are almost at the verge of collapsing and sustain jobs of Ugandans but at the same time, look at post-Covid-19 and figure out what shape of recovery we should anticipate and work towards,” he argues.

Byarugaba also recently told The New Vision, Uganda’s local daily that NSSF was yet to “see that massive slump in the economy to the extent that all our employers will be unable to make contributions”, which is why the Fund had in the interim decided to allow some employers in the affected sectors to defer payments to the Fund for 3 months.

“We don’t think this (the crisis) represents the entire economy,” argued Byarugaba in The New Vision Interview.

Raiding the NSSF granary is false victory

Byarugaba, however argues that however inventive and all these proposals are, save for the fact that most of NSSF’s money is sunk in medium to long term investments such as government bonds of over 5 years, whose exit at this material time would cost workers heavily, the cost of raiding NSSF’s granary by its owners would by far outstrip the benefits.

“The NSSF is the single largest retirement Fund in East Africa. Its assets are largely invested in Uganda. NSSF is a long-term investor. It is known that long-term assets are less liquid than short-term assets. Liquidity is also a function of the size of the markets. East African markets are small by all measures. Therefore, the narrow liquidity in these markets isn’t unique to NSSF but all investors in East Africa, he argues.

He goes on to say that tinkering with the NSSF coffers to the scale being proposed would cause an imbalance in the financial markets, given NSSF’s stabilising role in the larger scheme of things.

“In fact, one of NSSF’s core roles is to act as a natural provider of liquidity. For instance, in the last few weeks we have seen investors sell government of Uganda bonds. NSSF has been a buyer. Should there not be a strong market participant like NSSF, interest rates would have dramatically risen,” says Byarugaba, further adding: “Therefore, this long-term investment objective of NSSF brings added calmness and discipline in the markets.”

“If the NSSF was required to liquidate up to 20% of its assets (more than UGX 2.5 trillion), this would send ripple effects through the economy. The added value from those who spend their benefits would not surpass the economic implications of the decision,” he argues.

Byarugaba is supported by Prof. Waswa Balunywa, the Makerere University Business School Principal and also a former Board of Directors for Bank of Uganda. He says that much as the proposed pay-out to NSSF members, sounds inviting, it needs to be approached with a lot of caution.

“NSSF money is very important for the country. It is the hugest saving that we have,” he argues, saying that much as “it would be a very innovative way of getting a stimulus into the economy, that’s a lot of money that you would be releasing into the economy, it may put some kind of inflationary pressure on the economy.”

He is also worried that releasing such money to people who have spent most of their time as employees and not as business people, will trigger off wild spending, which spending, even though it triggers off demand in the economy, may not be beneficial to the owners of the money and could defeat the purpose for which this savings pool was created by an act of law.

“It is an innovative way of preventing the government from getting additional debt, because we (government of Uganda) are already indebted and our tax revenue is not growing fast enough. My thinking is that if this money is borrowed by individuals, it will not work. The only feasible person to borrow it, is the government. We could also look into NSSF investing in debentures/corporate bonds- these are long term loans to companies,” Balunywa says.

“If we are releasing money to elderly people, I am sorry it doesn’t work. But if it is for loans or debentures to well-established companies, that is good. If it is going to Government, of course, the government cannot fail to pay- government lives in perpetuity,” he further argues.

Catch 22: Too little, too late

Seasoned economist Dr. Fred Muhumuza also argues that the proposed NSSF pay-out is not practical as NSSF may not have the liquidity, but also, that even if NSSF had the money in cash, the costs to the economy could outweigh the benefits.

“75 percent of NSSF’s savings are already in government bonds, the rest is in form of shares in other firms like the crumbling Uganda Clays, buoyant UMEME and Housing Finance Bank, as well as real estates like Temangalo, Workers House, etc. This means the government has either to print money to realize the cash or use its scanty tax revenues to buy back those bonds from NSSF. It’s a catch 22 position,” he says, adding that government would have to borrow from elsewhere, especially the banks, to pay NSSF, which again would spiral interest rates- making a bad economy worse.

Dr. Muhumuza also says that the biggest part of the population which is very needy and vulnerable, who would have made such a radical idea necessary, do not save with NSSF.

“The few who do have very little savings with NSSF. Giving them 15 percent of their savings will not even amount to UGX1 million for many and yet the value of that UGX1 million at this point has been eroded by high prices….They will just blow it in a week or two,” he says.

NSSF should primarily exist for its members

Dr. Ramathan Ggoobi, a policy analyst who also teaches economics at Makerere University Business School (MUBS) is also against the proposed direct cash part pay-out of NSSF savings to its members and argues that is simply “bad economics.” He, however, insists that NSSF can and should have a role in buttressing the country against Covid-19 shocks as well as post-Covid-19 recovery.

“The best it (NSSF) can do, which they’ve already done, is to defer monthly subscriptions for a couple of months to enable employers retain cash flow and keep workers on the payroll and the latter to have a higher take home,” argues Dr. Ggoobi.

“Social security funds are meant for retirement and or extended unemployment. Anyone who failed to save a proportion of the 95% of their earnings cannot expect to be bailed out by the 5% they were compulsorily helped to save for their old age. This short term economic shock (Covid-19) should be dealt with using other fiscal interventions such as income support, deferment of loan repayment, deferment of PAYE and other statutory obligations including NSSF as I stated already,” he adds.

Ggoobi, however agrees with Kabushenga’s proposal that “if there are NSSF savers with mortgages and other rational debt and Covid-19 is threatening to expose the banking/financial system by causing liquidity challenges in the future due to increased NPLs, then the Bank of Uganda, banks, and NSSF (being the most liquid entity) should work out a “holy trinity” to get around the problem to bailout out both the individual savers and banks on a case-by-case basis.”

“What should not be done is giving people their NSSF savings to go to the market to buy food and other stuff,” he reiterates.

An opportunity to re-examine and expand social security

Kabushenga says the unique challenges being visited on the world by Covid-19 is an opportunity to re-examine everything, including social security, maintaining that the traditional meaning of social security as life after retirement only, needs to be rethought, way beyond things that only give social security funds, what he called “financial convenience.

“We are not talking about normal times,” he reasons, adding that Uganda, like the rest of the world is going to “require very radical departure from established thought” and that dogmatic and traditional solutions may prove to be “woefully inadequate”

“Sacred cows will be slaughtered,” he tweeted.

He also says merely pleading legislation is not enough.

“Let’s have a debate and out of this debate, will evolve a practical and workable solution. If you dismiss the debate and say the only position is that which is provided within the law, that is deflecting the discussion and that is wrong,” he says.

He also says that NSSF can try other innovative approaches like guaranteeing the loans that their members have which will reduce the risk of defaulting and therefore reduce interest rates and the repayments which will ease pressure for its members.

“Bottom-line, we are in unusual times, so we all have to think different, including NSSF Management. The ideological things we have been throwing around may not work. This is a time to think creatively- we need all our economists sitting together to come up with a solution,” he says, emphasizing that: “Our economists need to be open to debates and creating unique solutions. The least you can do is have a discussion on what other ways, members can be helped. Because for some members, the reality is if they are not helped now, their future will be ruined- even if you show up with UGX1 billion in the future.”

Like Kabushenga, Kaboyo too believes that out-of-the book solutions need be sought.

“The scenario we are in is complex, the touch and go approach will not work. We need a comprehensive smart stimulus that will be a combination of short term and long term measures that will require sacrifices from both government and the private sector,” he argues.

“Clearly the proposal for NSSF to release 10-20% is a creative one that can work in the short term but importantly there is need for other fiscal measures that will keep liquidity in the broader economy. In my view other short term interventions that can be considered would be; reduction of income tax from the current 30% to 15%, reduction of corporation tax from the current 30% to 15%, reduction of VAT from the current to 10%, this would ensure that some cash is retained in the business, coupled with quick refunds associated with VAT, suspending licenses fees for businesses and defer PAYE for a period of 6 months,” he says.

He also argues that in the long term, the government can consider setting up a special fund to support the different categories of business, with more emphasis placed on small businesses at reduced interest rates.

“Alongside this would be to consider a government-supported or guaranteed insurance scheme for business disruption,” he concludes.

Vivo Puts Two Downtown Kampala Shell Stations up for Sale Amid Congestion Concerns

Vivo Puts Two Downtown Kampala Shell Stations up for Sale Amid Congestion Concerns