The Constitutional Court has restricted the application of Section 15 of the Tax Appeals Tribunal Act, limiting its application to only cases where the tax dispute is about the amount of tax payable. In a majority 3 of 5 ruling, Justices Kenneth Kakuru, Egonda-Ntende and Ezekiel Muhanguzi ruled that, “Section 15 of the Tax Appeals Tribunal Act – in so far as it compels an objector to a tax assessment whose challenge is not with regard to the amount of tax payable, to pay to the tax authority 30% of the tax assessed – is inconsistent with Article 44 of…

Big win for taxpayers as Constitutional Court restricts requirement to pay 30% of tax under dispute before challenging URA in court

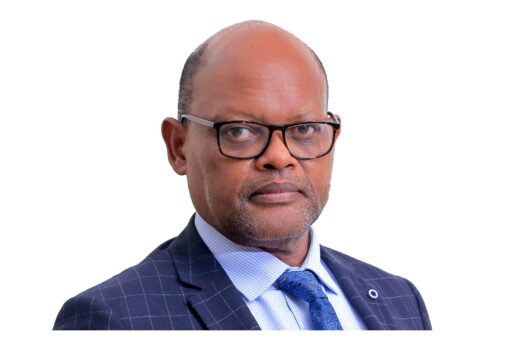

LEFT-RIGHT: Justices Kenneth Kakuru, Egonda-Ntende and Ezekiel Muhanguzi said the TAT Act requirement to pay 30% of a tax under objection before getting access to justice was inconsistent with Section 44 of the Constitution that guarantees access to justice as a non-derogable right.