Money remains expensive in Uganda. Bank of Uganda has kept its Central Bank Rate (CBR) at 9.75% since August 2025, one of the longest periods without adjustment.

The message is clear: maintain macro stability in a world still shaken by global shocks, even if it means keeping domestic credit costly.

In practice, this stance raises funding costs for banks, which then pass them on to businesses and households.

Inflation eased to 3.4% in October, down from 4% in September, but that only widens the spread between the policy rate and inflation—now over 600 basis points.

This makes Uganda’s real interest rates among the highest in East Africa.

Below the headline numbers, liquidity is tightening. Private-sector credit growth has slowed to 8.5% year-on-year, down from double digits earlier.

Yet customer deposits have surged nearly 29% to UGX8.4 trillion, proof that money exists but is not circulating.

Broad money (M3) growth has cooled to 7.8%, its lowest pace in over a year. Interbank lending rates have risen to 9.1%, up from 8.2% in June.

Banks are lending more cautiously. Non-performing loans (NPLs) have edged up to 5.1%. Loan-to-deposit ratios hover around 75%, near prudential limits.

Interbank transaction volumes have dropped 11% since June. Meanwhile, the central bank has been mopping up liquidity, absorbing more than UGX 1.3 trillion through overnight repos in August.

Government borrowing has deepened crowding-out. Domestic debt rose to UGX 37.8 trillion in September, from UGX 35.6 trillion three months earlier, pushing Treasury yields into the 13–16% range.

Banks are increasingly favouring high-yield government securities over private-sector lending.

Even foreign exchange reserves fell to $4.3 billion, covering 4.2 months of imports, down from 4.4 months in June, further tightening buffers.

In short, Uganda’s liquidity problem isn’t just high borrowing costs; it’s money that isn’t moving.

As one senior banker put it: “Liquidity exists, but it’s trapped—in government securities, in bank reserves, in fear.”

For CEOs and CFOs, this reality is reshaping corporate strategy. Every borrowed shilling must now yield more.

Boards are tightening payback periods, running stress tests for interest-rate and currency shocks, and prioritising liquidity protection over expansion.

Real Estate: First to feel the squeeze

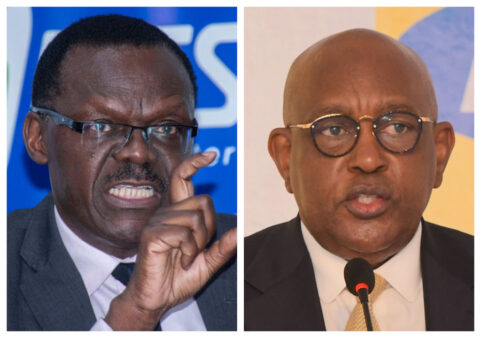

Real estate has felt the pinch earliest and hardest. Knight Frank’s Managing Director, Judy Rugasira Kyanda, says the sector’s financial strain is no longer theoretical.

“The single biggest challenge, indirectly through our clients, is the rising cost of capital and its ripple effect across the market,” she notes.

Financing new projects or refinancing existing ones has become markedly more expensive, worsened by currency volatility in recent months.

Banks, she adds, are losing appetite for real estate lending, preferring the safety of government securities.

Knight Frank’s response is strict financial discipline. The firm is guiding clients toward prudent capital structuring, prioritising projects with strong fundamentals, and adopting phased developments that generate cash early.

Internally, budget controls and operational efficiency have become central to survival.

Broll Property Group’s Managing Director, Moses Lutalo, offers a sector-wide view. As a services business that does not own property, Broll sees trends across clients.

He notes that real estate is inherently cyclical and heavily dependent on macroeconomic stability, interest rates, inflation, and disposable income levels dictate affordability and investment appetite.

However, policy frictions make the environment even tougher. VAT on residential property is exempt rather than zero-rated, making input VAT a sunk cost.

EFRIS requires VAT returns every 15 days, misaligned with quarterly rental cycles, forcing developers to remit tax before receiving payments.

Financing structures also create strain because banks use short-term deposits to fund long-term projects, pushing up pricing.

Capital gravitates toward transparency and scale. Investment-grade developments such as Arena Mall and Acacia Mall continue to attract institutional interest, while smaller, fragmented projects lacking governance and data fail to meet investor thresholds.

Lutalo believes technology, particularly blockchain-based land registries, could transform transparency and unlock capital across markets.

Manufacturing: Running lean to stay afloat

At Innovex, foreign exchange exposure on imported electronics and cloud services is the biggest financial risk. CEO Douglas Baguma says it “eclipses the headline cost of shilling-denominated debt.”

Innovex manages risk through dollar-matched revenue from regional clients, staggered capital spending, and increased local production via its SMT line.

Supplier prepayments and blended financing help avoid expensive bank loans.

Furthermore, Quality Chemical Industries offers another demonstration of resilience.

Although revenue dipped 2.6% in the six months to September 2025 due to exchange-rate effects, efficiency improved markedly.

Gross profit rose 7.9%, margins strengthened from 38.6% to 42.8%, and operating cash flow surged fivefold to UGX 51.4 billion.

Despite the squeeze, Quality Chemicals launched 16 new products and began constructing a $36 million WHO-compliant plant, clear evidence that discipline can power growth even in a tight market.

Finance: Navigating expensive money

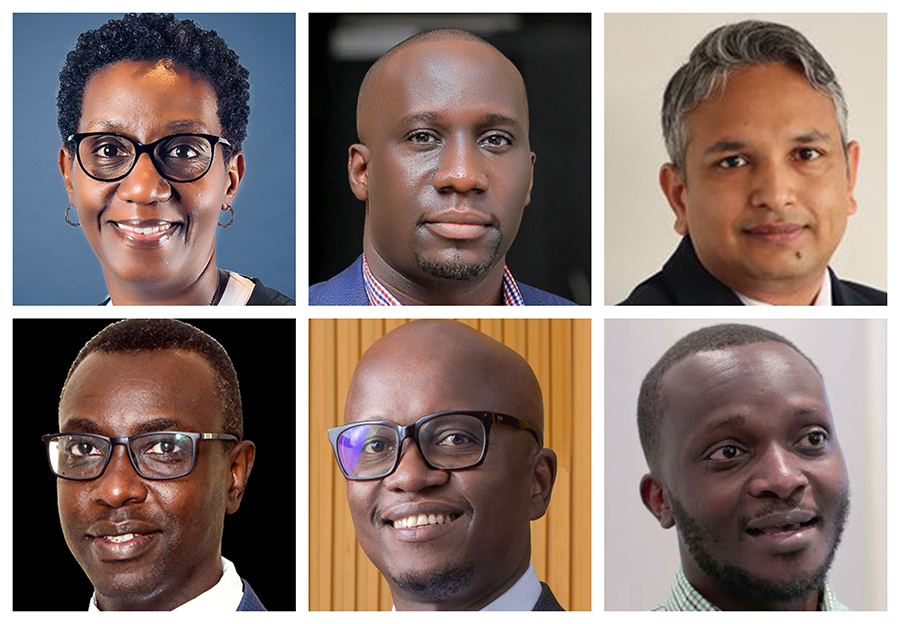

Stanbic Uganda Holdings reported profit after tax of UGX 278 billion, up 18%, with a 27% return on equity. Strong as the numbers appear, they reflect deeper dynamics.

Deposits climbed 29% as savers sought stability, while lending grew 12.9%, showing corporations are only borrowing for high-certainty, fast-payback projects.

Capital markets, meanwhile, are rising in importance. Assets under management at SBG Securities jumped 327% to UGX 216 billion, and Uganda’s unit trust market continues its rapid expansion.

Manufacturers are localising production. Exporters are hedging foreign exchange exposure.

Real estate developers are partnering with institutional investors and restructuring financing models.

Across sectors, businesses are prioritising discipline over aggressive expansion.

Corporate finance: A new discipline

A 2024 study by Makerere University’s Jacqueline Kyabishikyi found that firms with strong control over working capital consistently outperform peers.

Boards now monitor cash conversion cycles with the same intensity as revenue growth.

MTN’s UGX 370 billion syndicated loan, structured entirely in shillings, offers a blueprint for managing foreign exchange exposure.

Borrowing in the same currency in which the company earns stabilises its balance sheet and creates predictable debt service.

Businesses are tightening payment cycles, aligning debt with revenue currencies, formalising hedging policies, and increasingly turning to capital markets and structured finance.

Capital discipline in practice

MTN CFO Andrew Bugembe says the telecom balances high capital-expenditure needs with liquidity pressure through deliberate allocation.

Investments target high-growth segments such as data and mobile money. Operational discipline, strengthened working capital, and the Expense Efficiency Programme anchor performance.

Infrastructure sharing with Airtel reduces capital duplication. Refinancing UGX 370 billion of debt in local currency removes foreign exchange volatility for the next five years.

Overdraft facilities provide operational flexibility, and many contracts have been converted to shilling-denominated terms.

Bugembe argues that long-term success demands focusing on value creation rather than expansion alone.

Higher internal rate of return, shorter payback periods, and strong return on investment capital must guide decision-making.

The new liquidity playbook

Stanbic Bank CFO Ronald Makata says companies are “far more proactive” in managing liquidity under tight monetary conditions.

Many are renegotiating credit terms, improving cash-flow forecasting, and optimising the cash conversion cycle.

However, he notes there is persistent overreliance on traditional bank credit and poor optimisation of idle cash.

With high yields, stable currency, and contained inflation, many corporates are beginning to adopt strategic positions in long-term government securities to hedge against shocks.

Makata expects softer interest rates as external funding resumes post-2026.

For companies seeking investment, he emphasises the importance of accurate forecasting, strong liquidity management, and clear governance, foundations that build investor confidence.

The CFO’s new imperative

Across Uganda’s corporate landscape, one principle now defines strategy: liquidity is everything.

CFOs are judged not only by growth, but by discipline; how efficiently capital is deployed, how risks are hedged, and how working capital is controlled.

That discipline means pacing capital expenditure rather than freezing it, matching debt currency to revenue currency, diversifying funding sources, strengthening forecasting, and deepening operational collaboration.

As one CEO put it: “In this new reality, growth belongs to the deliberate. Clarity, discipline, and timing—not optimism—are what sustain businesses when capital is costly.”

Standard Chartered Kenya Targets Nakumatt Properties in $14.3 Million Debt Recovery Battle

Standard Chartered Kenya Targets Nakumatt Properties in $14.3 Million Debt Recovery Battle