At a ceremony to mark the transition from Orient Bank to I&M Bank Uganda in November 2021, Suleiman I. Kiggundu, the then Orient Bank Chairman and now I&M Bank Chairman promised stakeholders that the “rebranding of Orient Bank to l&M Bank Uganda, would not only unlock the bank’s potential, but also enable the bank to reach out to more customers within Uganda, and in Eastern Africa as a whole.

He also said that the transition would enable the bank to “roll out a more diversified product mix to our diverse target market to meet their financial lifestyle and requirements”.

In a recent interview, Sam Ntulume, the I&M Bank Uganda Ag. Managing Director and Chief Executive Officer says the transition has allowed the beginning of a “new era under a new name but with the same zeal and commitment to continuously deliver on our customer needs”.

“We are now taking advantage of the opportunities within the I&M Group to expand our market reach and penetration in Uganda and aggressively position ourselves as a key enabler for personal and business growth,” Mr. Ntulume says, adding: “I believe that the future portends greatness for both our former Orient Bank customers and the new customers of I&M Uganda as well as its stakeholders”.

Ntulume, explains that under the new I&M regime, the bank has been able to tap into the larger I&M Group’s experience, resources and heritage to transform the customer experiences as well as the bank into a “pacesetter in transforming the lives of its customers”.

“Through tapping into the I&M Group’s investments in digitalisation as well as product portfolio and best-practice customer experiences, we have in just one year been able to roll out a series of innovative products and services to our customers in line with the promises we made, at the time of transitioning from Orient Bank to the I&M brand,” he said.

Some of the new services rolled out by I&M Bank include investment banking, wealth management services and offshore banking.

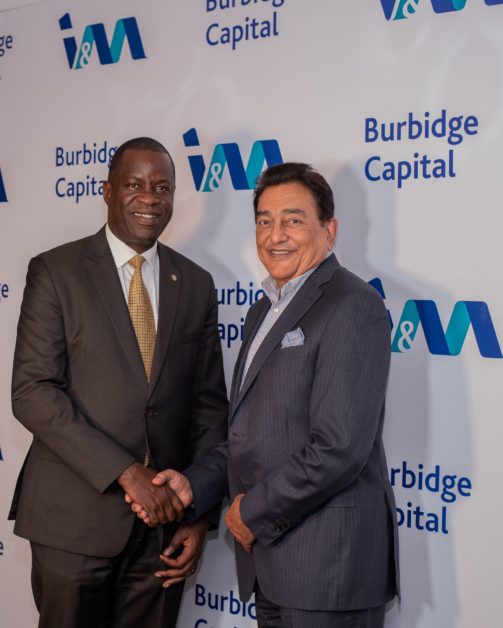

Investment banking is offered through I&M Burbidge Capital (IMBC), a subsidiary corporate finance advisory firm of the I&M Group. IMBC advises businesses in Sub-Saharan Africa on significant capital raising through IPOs, private equity, debt and M&A transactions, with a focus on transactions with a value of USD 5 million- USD 250 million. IMBC services include Strategic Options Advisory, M&A Advisory, Equity Capital Raising Advisory, Private Equity Advisory and related tax advisory.

Wealth Management Services among others include investment, financial, tax and estate planning advisory services. With Offshore Banking, which is offered in partnership with Bank One Mauritius, a subsidiary of the I&M Group, clients enjoy several services such as being able to hold, make and receive payments in multiple currencies as well as receive international expertise and investment advice. Offshore Banking clients can also be facilitated to open foreign accounts, amongst other services.

These services will be offered at the bank’s first signature branch in Kampala Kingdom. The one-of-a-kind 3-in-1 Kingdom Kampala Branch will host the bank’s affluent banking brand known as I&M Select Banking, as well as a Corporate Banking Centre and a 24/7 digital self-service hub, known as the I&M Digital Pod.

The new Kingdom Kampala Branch, although already opened, will be officially launched, come this March 2023.

The I&M Select Banking Service is specifically tailored to the bank’s premium banking segment and provides specially packaged products and services that complement their lifestyle and financial requirements. It also offers several recognition benefits such as complementary and concessional services and makes some specialised products available to members. Some of the exclusive benefits available in the I&M Select Centre include Wealth Management Services as well as Offshore Banking.

I&M Select Banking Service members enjoy benefits such as the I&M World Elite or World Debit Mastercard, access to the I&M Select Centre Access, specially-designed chequebooks, free travel insurance, safe deposit lockers, I&M Infinite Credit Card and pre-approved term loans, among other benefits.

“The new Kingdom Kampala Branch has been designed to reflect our digitisation agenda and our branches of the future that will dedicate more space and time for consultations, and advisory services, while more and more of the transactional services like deposits and withdrawals for both individuals and corporates as well as inquiries will be digitised and self-service,” reiterates Ntulume.

“We are delighted that we are building on nearly three decades of the Orient Bank legacy and shaping a new chapter in the lives of our customers,” he adds.

“One year later after the rebranding, we are happy that we are delivering on the promises we made. We would like to encourage our especially corporate and high net-worth customers to embrace these value-creating services at our all-new and one-of-a-kind Kingdom Kampala Branch and benefit from a wide range of customised products and advisory services,” emphasises Ntulume.