Absa Bank Uganda has introduced the country’s first innovative and exciting cardless withdrawal function on its Automated Teller Machines (ATMs). The innovation allows customers to use a QR Code generated from the Absa Banking App on any smartphone device to withdraw cash at any Absa ATM countrywide. Speaking during a media briefing to launch this new offering, Musa Jallow, Retail Director, Absa Bank Uganda said, “Digital payments are evolving at a fast pace, particularly during this COVID-19 era where public health is a primary concern. Absa is responding to the needs of customers who are looking for convenience and security…

DIGITAL INNOVATION: Absa Bank Uganda Unveils Cardless Withdraw Functionality on ATMs

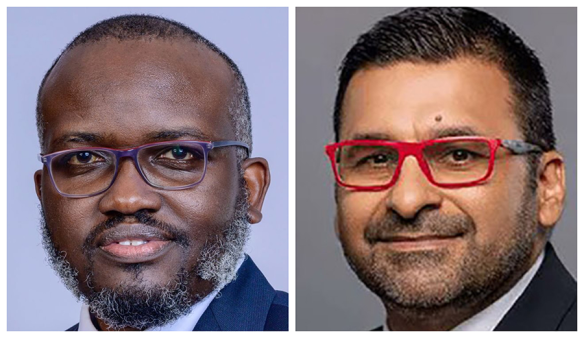

Absa's Retail Banking Director, Musa Jallow, demonstrates the use of the QR Scan to Withdraw functionality