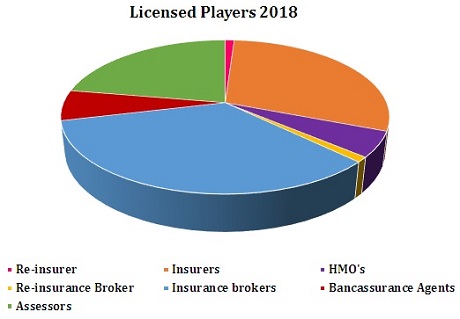

The Uganda Insurance Regulatory Authority (IRA) has licensed 95 players to transact insurance business in 2018. The 4.3 percentage increase from 91 players that transacted insurance business in 2017 saw IRA license 28 insurance companies, one re-insurer, five Health Membership Organisations, 32 insurance brokers, one re-insurance broker and 22 loss assessors/adjusters.

Of the 28 insurance companies licensed, 19 are non-life firms and 9 firms for life assurance business.

The regulator has also licensed six banks; Bank of Africa, Barclays Bank, Diamond Trust Bank, Finance Trust Bank, NC Bank and Stanbic Bank to start selling insurance products and provide insurance services to their clients.

The Authority renews licences of all insurance players annually as a way of scrutinising their viability and protect the interests of policyholders and beneficiaries.

In 2017, the IRA licensed 29 Insurance companies (20 non-life or general insurance companies and 9 Life companies), 6 HMOs, 35 Insurance brokers and 21 Loss Assessors.

Although insurance penetration registered minimal drop from 0.76 in 2015 to 0.73 in 2016, the sector has registered steady growth generally given other indicators. For instance, insurers paid at least Shs37 billion more in claims in 2016 compared to the Shs213 billion they paid in 2015.

Overall, however, the industry grew at 4% in 2016 with IRA forecast for 2017 standing between 6% and 8% particularly due to changes brought about in the Financial Year 2017/2018 policies on Motor Third Party Insurance, Marine Insurance and Agriculture Insurance that the government and the regulator enforced.

Figures for the industry performance for 2017 are not yet available, but, according to IRA, in 2016, the gross premium underwritten by the insurance industry increased from Shs612 billion in 2015 to Shs634, representing an overall growth of 3.6%.

Non-life insurance business dominated the industry in terms of premiums underwritten with 70.9% down from 75.99% in 2015. The status quo is very unlikely to change given the disparity in the number of general versus life insurers licensed.

Life insurance, on the other hand, accounted for 20.87% in 2016, up from 16.36% in 2015.

Health Membership Organisations accounted for 8.22% in 2016, up from 7.67% in 2015.

IRA has advised the public to deal with only the firms licensed to transact insurance business by the Authority. All licensed persons are also by law required to display their licenses prominently at their places of business and in each of their branch offices in the country.

Licensed insurance companies for 2018

Non-Life Insurance Companies

Alliance Africa General Insurance Ltd

APA Insurance (U) Ltd.

Britam Insurance Co. (U) Ltd

CIC General Insurance (U) Ltd

Excel Insurance Co. Ltd.

First Insurance Company Ltd.

GoldStar Insurance Co. Ltd

ICEA General Insurance Co. Ltd

Liberty General Insurance Co. Ltd

NIC General Insurance Co Ltd.

NOVA Insurance Co. Ltd.

Pax Insurance Company Ltd

Phoenix Assurance Ltd

Rio Insurance Company Ltd.

Sanlam General Insurance (U) Ltd.

Statewide Insurance Co. Ltd

The Jubilee Insurance Co. of Uganda Ltd.

TransAfrica Assurance Co. Ltd.

UAP Old Mutual Insurance Uganda Ltd

Life Insurance Companies

CIC Africa Life Assurance (U) Ltd

ICEA Life Assurance Co. Ltd

Liberty Life Assurance (U) Ltd.

Metropolitan Life Uganda Ltd

NIC Life Assurance Co. Ltd

Prudential Assurance (U) Ltd

Sanlam Life Insurance Co.

UAP Life Assurance Uganda Ltd.

The Jubilee Life Insurance Co. of Uganda.

UAP Old Mutual Insurance Uganda Ltd

Powered by dfcu: How a Bank Overdraft, Grit, and Vision Lifted Dr. Richard Wemesa onto Uganda’s Best Farmers List

Powered by dfcu: How a Bank Overdraft, Grit, and Vision Lifted Dr. Richard Wemesa onto Uganda’s Best Farmers List